During 2024 LAVA ran ‘Hot Take Tuesdays’ where we asked M&A and Private Equity experts for their thoughts on key elements of M&A to discover exactly what the market thinks is important, influential, or a real pain in the backside.

Lets see what they said…

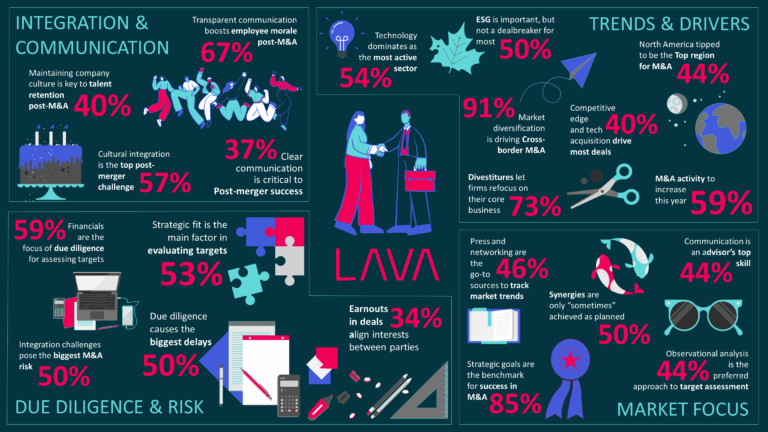

- Post-merger success hinges on communication and culture

- Clear communication was voted the most critical factor for post-merger integration success (37%), with cultural alignment coming close behind. This highlights the importance of a people-focused approach, ensuring teams feel informed and engaged throughout the process. Additionally, cultural integration was flagged as the top post-merger challenge (57%), underscoring its pivotal role in long-term success.

- ESG: Important, but not yet seen as critical

- When it comes to environmental, social, and governance (ESG) factors, half of the respondents agreed they are important but not critical. While ESG is increasingly influencing the success or failure of deals, it hasn’t yet become the deciding factor for a lot of professionals’ M&A decisions.

- Hotspots for M&A activity

- North America was seen as the region most likely to see high M&A activity in the next 12 months (44%), followed by EMEA. Sector-wise, technology dominated expectations, with 54% forecasting it as the leading area for deals, reflecting ongoing innovation and digital transformation trends.

- Drivers of deals and risks

- The primary motivations for pursuing deals were acquiring competitive advantage and technological capabilities (40%), highlighting a focus on innovation-led growth. However, due diligence was cited as both the biggest cause of delays in M&A processes (50%) and the most critical aspect of target evaluation (50%). Integration challenges and regulatory issues also remain top risks, demonstrating the complexity of executing deals successfully.

- Strategic fit and alignment as priorities

- When evaluating M&A targets, 53% of respondents identified strategic fit as the primary factor, ahead of financial metrics. Earnouts are also being used to align interests between buyers and sellers, with 34% highlighting their importance. This suggests that aligning acquisitions with broader business objectives is more important than ever.

- The human factor

- Employee morale and retention were recurring themes. Transparent communication was deemed the most effective way to maintain morale post-transaction, while 40% of respondents believe that preserving company culture is critical for retaining talent. Career development opportunities and clear communication of future plans also featured prominently, showing that firms must invest in their people to maximise their deals.

- Cross-border M&A trends

- Market diversification was overwhelmingly identified as the main driver for cross-border deals (91%), illustrating how companies are using acquisitions to expand into new territories and reduce risk. On the flip side, geographic realignment was cited as the primary reason for divestitures (73%), showing how firms are optimising their portfolios to focus on core markets.

- M&A advisors: The skillset that matters

- Communication skills (47%) were rated as the most important for M&A advisors, followed by analytical abilities. Strong interpersonal skills are vital for managing stakeholder relationships and guiding transactions, especially in high-stakes environments, so choosing the right advisor can make all the difference.

The road ahead

It’s great to see a cautious but optimistic outlook for 2025, with 59% of M&A experts expecting activity to increase in the coming year. While challenges like due diligence delays and integration risks persist, the appetite for strategic deals remains strong, and the increased certainly the UK is enjoying post-budget is providing reassurance across the board.

These insights underscore the importance of balancing strategic objectives with human factors to drive value in the M&A space. For firms eyeing growth, the message is clear: success lies in effective communication, robust planning, and a keen focus on cultural alignment.